3,200.610 -14.92 (-0.46%)

| |||

Singapore shares drop 0.5% as HK bill fuels trade deal worries

28 Nov 2019 18:15

By Navin Sregantan

ASIAN equities were mostly lower after US President Donald Trump signed the Hong Kong pro-democracy bill, just a day after reassuring markets that Beijing and Washington were in the "final throes" of a mini trade deal.

"Although we knew this was coming, the market has reacted a bit negatively in a typically low liquidity period which is likely getting exacerbated by the Thanksgiving holiday-thinned trading conditions," AxiTrader chief Asia market strategist Stephen Innes said.

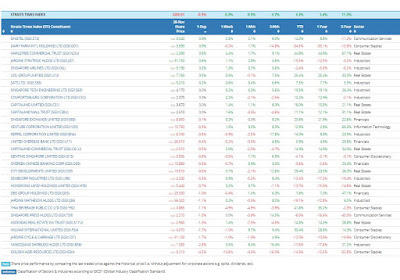

On Thursday, Singapore's Straits Times Index (STI) retreated 14.92 points or 0.5 per cent to close at 3,200.61 after investor sentiment dampened.

Elsewhere in the Asia-Pacific, China, Hong Kong, Japan, Malaysia, South Korea and Taiwan finished lower. Bucking the trend was Australia, where the benchmark ASX 200 was lifted by telcos.

With Mr Trump giving the bill the go-ahead, investors are left wondering what China's next course of action in this long-drawn trade stand-off will be.

In all fairness, Mr Trump is strapped. With the bill garnering bipartisan support, exercising the presidential veto is fruitless and highly likely to be overruled by the upper and lower chambers on Capitol Hill.

"I don't think he wants to inflame trade tensions. And I get the sense that he sees this as a problem for China and Hong Kong, and maybe is reluctant to get involved," ING Asia-Pacific chief economist Robert Carnell wrote.

In Singapore, trading volume stood at 1.22 billion securities, 6 per cent over the daily average in the first 10 months of 2019. Meanwhile, total turnover clocked in at S$811.82 million, 78 per cent of the January-to-October daily average.

Across the market, decliners beat advancers 212 to 170. The blue-chip index had 19 of its 30 counters in the red.

For a third successive session, Golden Agri-Resources was the STI's most active counter, dropping S$0.01 or 4.6 per cent to S$0.21 with 43.9 million shares traded.

Oil prices fell a second day after data showed US inventories increased against street expectations and on trade deal worries. This impacted local upstream oil and gas firms like Rex International, which eased 0.6 Singapore cent or 3.2 per cent to 18.3 cents, and GSS Energy, which shed 0.3 Singapore cent or 3.4 per cent to 8.5 cents.

Companies with sizeable exposure to the offshore and marine (O&M) sector also saw share prices fall. Rig builder Sembcorp Marine retreated S$0.03 or 2.3 per cent to S$1.26 while conglomerate Keppel Corp dipped S$0.02 or 0.3 per cent to S$6.74.

Among property plays, First Sponsor rose S$0.04 or 3.1 per cent to S$1.34, after selling an Amsterdam office building to its associate for 55.3 million euros (S$83.4 million).

There was a flurry of activity on the counter of Catalist-listed P5 Capital, which edged up 0.1 Singapore cent or 3.1 per cent to close at 3.3 cents on 127 million shares traded, the most on the Singapore bourse. The high volumes were due to married deals amounting to 50.8 million shares sold at 6.3 cents, a 96 per cent premium over Wednesday's closing price.

Source: Business Times Breaking News