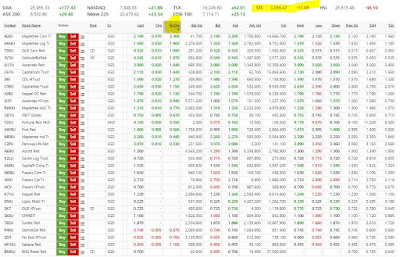

Could this be the new breakout gap to ignite a new rally?

This is a bullish follow up from a large bullish engulfing candlestick, which ate up a group of 3 previous days indecisive candlesticks.

Source and recommended reads :

https://sginvestors.io/market/sgx-share-price-performance/straits-times-index-constituents

https://sginvestors.io/market/sgx-breakout-price-3-month-high-volume-above-average

https://sginvestors.io/market/sgx-breakout-price-3-month-high-volume-above-average

Singapore business

news

https://www.businesstimes.com.sg/stocks

https://www.straitstimes.com/business/companies-markets

https://www.theedgesingapore.com/

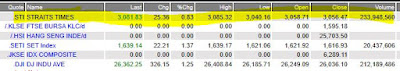

US Indices &

stocks performance

https://www.investing.com/indices/

https://money.cnn.com/data/fear-and-greed/

DISCLAIMER:

Hey,

All information updates, tables and charts are for informational

purposes only; they are not intended for trading purposes or advice.

We do not and cannot guarantee the accuracy of the information.

Please consult your broker or financial representative to verify pricing

before executing any trade.

We are not liable for any actions taken in reliance on information

contained herein.

With best regards,

Martin Seah