| Quote |

Name |

Last |

Chg |

%Chg |

High |

Low |

Open |

Close |

Volume |

Time |

|

| .STI |

STRAITS TIMES |

3,304.27 |

-7.26 |

-0.22 |

3,321.09 |

3,301.39 |

3,317.00 |

3,311.53 |

218,248,860 |

17:20:00 |

|

| /.KLSE |

FTSE BURSA KLC/d |

1,676.61 |

0.48 |

0.03 |

1,677.76 |

1,672.41 |

1,675.82 |

1,676.13 |

114,832,800 |

17:05:01 |

|

| /.HSI |

HANG SENG INDE/d |

28,185.98 |

-,327.02 |

-1.15 |

28,470.10 |

28,066.13 |

28,447.96 |

28,513.00 |

1,909,262,048 |

16:09:36 |

|

| .SETI |

SET Index |

1,721.33 |

5.33 |

0.31 |

1,725.42 |

1,707.77 |

1,716.05 |

1,716.00 |

18,854,809 |

17:53:57 |

|

| .JKSE |

IDX COMPOSIT |

6,320.44 |

31.98 |

0.51 |

6,327.98 |

6,308.00 |

6,312.10 |

6,288.46 |

10,733,461,500 |

17:15:00 |

|

"THE STRAITS TIMES - Fresh sanctions on Iran, upcoming Sino-US meeting also help push down STI

Observers noted a July rate cut in the US has already been priced in, and that the Osaka meeting should be viewed as a short-term market catalyst amid a global slowdown...

CMC Markets analyst Margaret Yang said: "The most likely outcome of the G-20 is another trade truce with no further tariffs implemented and no meaningful deal reached. But they'll keep talking."

Investors continued to pick up real estate investment trusts (Reits) in the light of possible US rate cuts but some dealers say that valuations are high. UBS Global Wealth Management joined the chorus yesterday, noting local Reits are "beginning to look overpriced".

Investors have been turning to the defensive telecommunications sector of late. Singtel was the benchmark index's most traded yesterday, adding 0.9 per cent to $3.48 with 41.8 million shares done. Netlink NBN Trust rose 1.7 per cent to 89 cents and StarHub gained 1.3 per cent to $1.55.

A Singapore Exchange report yesterday showed telcos were the top net buy sector in May, drawing institutional inflows of $135.8 million. In the year to June 21, the three telcos averaged a total return of 9 per cent..."

Read more at

https://www.straitstimes.com/business/companies-markets/spore-shares-dragged-down-by-profit-taking?utm_source=emarsys&utm_medium=email&utm_campaign=ST_Newsletter_AM&utm_term=S%27pore+shares+dragged+down+by+profit-taking&utm_content=26%2F06%2F2019

|

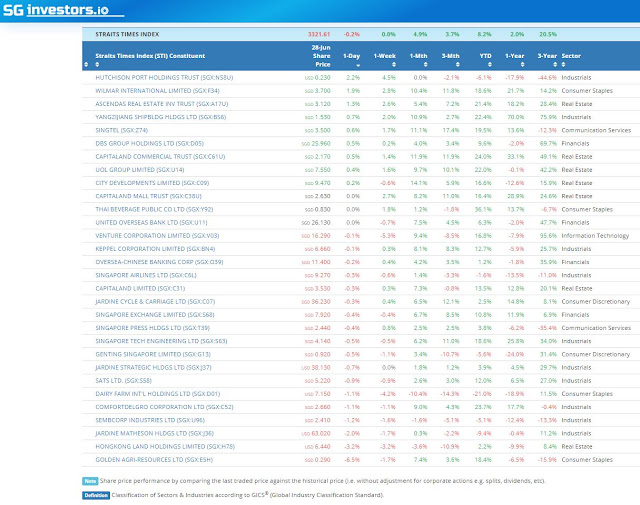

| STI gap up and moved above its channel resistance but it retraced and close lower, bearish engulfing yesterday's spinning top. |

Disclaimer:

Hey,

All information updates, tables and charts are for informational purposes only; they are not intended for trading purposes or advice.

We do not and cannot guarantee the accuracy of the information.

Please consult your broker or financial representative to verify pricing before executing any trade.

We are not liable for any actions taken in reliance on information contained herein.

With best regards,

Martin Seah