3,170.680 -11.89 (-0.37%)

| |||

Singapore shares resume drop on Thursday on virus fears

30 Jan 2020 18:26

By Navin Sregantan

WITH deaths from the Wuhan Coronavirus rising quickly and total infections nearing 2003's Sars outbreak count, Asian equities resumed their downward path after Wednesday's relief rally on bargain hunting.

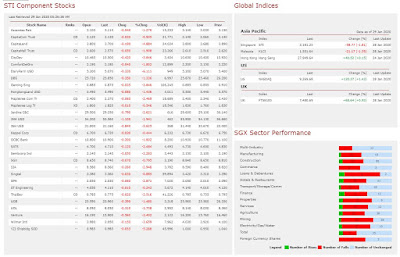

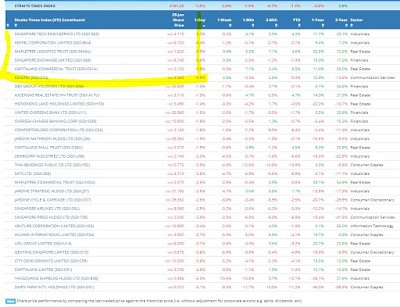

Singapore's Straits Times Index (STI) ended Thursday's session with a fall of 11.89 points or 0.4 per cent to 3,170.68.

Elsewhere, Australia, Japan, Hong Kong, Malaysia and South Korea were lower. On its return after a week off, Taiwan's Taiex Index dived 696.97 points or 5.8 per cent to 11,421.74, registering its largest single-day drop since October 2018.

Chinese markets will resume trading on Monday.

Much is still unknown about the virus and as a result, markets are understandably fraught with worry. But Chinese authorities have been hard at work in ramping up efforts to contain the spread.

"While we are cautious that the virus may spread/mutate, we are aware of reports which suggest infected patients are being cured, detection kits and vaccines are being developed," Jefferies Singapore analyst Krishna Guha noted.

It's worth pointing out that while the death toll and total infection figures have risen quicker than during the Sars period, the fatality rate is considerably lower.

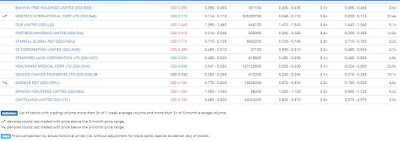

Trading volume in Singapore was 2.41 billion securities, double the 2019 daily average. Total turnover was S$1.43 billion, 35 per cent more than last year's intraday mean.

Decliners trumped advancers 303 to 170, with 19 of the benchmark's 30 counters ending in the red.

With market attention focused on the Wuhan virus, healthcare-related stocks have been the hot ticket of late. But many medical penny plays saw their scorching runs fizzle out on Thursday.

Instead, punters rotated into other listings, including property management group OEL, which surged 1.4 Singapore cents or 66.7 per cent to 3.5 cents with 241.9 million shares traded.

?The market seemed to play on recent news of the possibility that OEL?s new investors might enter healthcare. But at present no concrete details have been announced,? a trader told The Business Times.

Among real estate investment trusts (Reits), Starhill Global Reit edged up S$0.01 or 1.4 per cent to S$0.72 after posting a flat Q2 distribution per unit of 1.13 Singapore cents, in line with street expectations.

"While its Singapore retail portfolio is showing signs of a turnaround, we expect tenant sales to see a near-term hit due to the expected sharp slowdown of Chinese visitors," RHB Securities analyst Vijay Natarajan said.

Venture Corp was again a standout among STI counters, climbing S$0.27 or 1.7 per cent to S$16.41. Shares in the electronic services provider have gained 3.2 per cent since key client Philip Morris International (PMI) agreed on Tuesday to collaborate with South Korean tobacco giant KT&G on the latter's smoke-free products outside South Korea.

Citi Research analysts view this development as a positive for PMI as a wider range of products should help it gain further market share.

That said, they noted in a Jan 29 report: "We are not able to read if this means there will be greater commitment to investing in research and development and further product development."

Source: Business Times Breaking News

Source and recommended reads :

https://sginvestors.io/market/sgx-share-price-performance/straits-times-index-constituents

https://sginvestors.io/market/sgx-breakout-price-3-month-high-volume-above-average

https://sginvestors.io/market/sgx-breakout-price-3-month-low-volume-above-averagehttps://www.investingnote.com/posts/1809889

https://sginvestors.io/market/sgx-breakout-price-3-month-high-volume-above-average

https://sginvestors.io/market/sgx-breakout-price-3-month-low-volume-above-averagehttps://www.investingnote.com/posts/1809889

Singapore business news

https://www.straitstimes.com/business/companies-markets

https://www.theedgesingapore.com/

US Indices & stocks performance

https://www.investing.com/indices/

https://money.cnn.com/data/fear-and-greed/

DISCLAIMER:

Hey,

All information updates, tables and charts are for informational purposes only; they are not intended for trading purposes or advice.

We do not and cannot guarantee the accuracy of the information.

Please consult your broker or financial representative to verify pricing before executing any trade.

We are not liable for any actions taken in reliance on information contained herein.

With best regards,

Martin