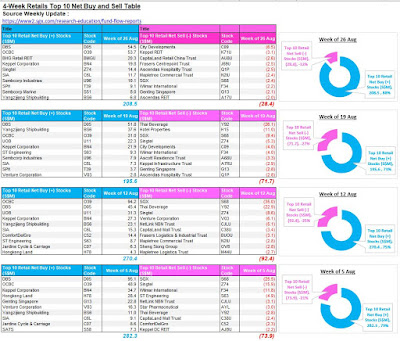

Week of 26 August 2019

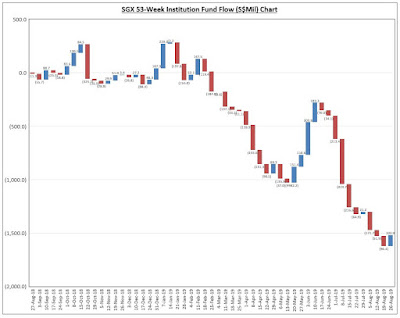

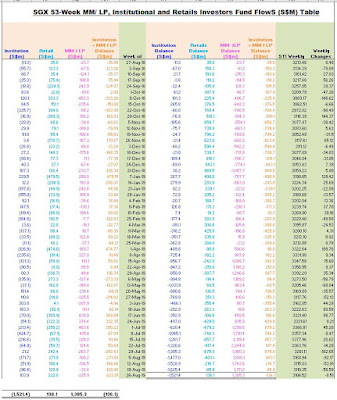

Institutional investors net buy (+S$103.9m) vs. (-S$96.4m) a week ago

Retail investors net buy (+S$222.0m) vs. (+S$128.9m) a week ago

Summary

- Institutions' 1st weekly positive inflow of more than S$100mil in 11 weeks (since week of 17th Jun).

- Financials, REITS and Real Estate (excl. REITs*) received the largest positive fund flows.

- Industrials was the leading sector of top negative fund flow, led by Keppel Corp, SembCorp Industries and YZJ Shipping.

- Both REITS and Real Estate (excl. REITs*) had received 3 consecutive weeks of positive fund flows.

Top 10 Institution Net Buy (+) Stocks

$UOB(U11.SI)

$DBS(D05.SI)

$Mapletree Com Tr(N2IU.SI)

$CapitaCom Trust(C61U.SI)

$CapitaLand(C31.SI)

$CityDev(C09.SI)

$ST Engineering(S63.SI)

$SingTel(Z74.SI)

$SATS(S58.SI)

$Genting Sing(G13.SI)

- Institutions' 1st weekly positive inflow of more than S$100mil in 11 weeks (since week of 17th Jun).

- Financials, REITS and Real Estate (excl. REITs*) received the largest positive fund flows.

- Industrials was the leading sector of top negative fund flow, led by Keppel Corp, SembCorp Industries and YZJ Shipping.

- Both REITS and Real Estate (excl. REITs*) had received 3 consecutive weeks of positive fund flows.

Top 10 Institution Net Buy (+) Stocks

$UOB(U11.SI)

$DBS(D05.SI)

$Mapletree Com Tr(N2IU.SI)

$CapitaCom Trust(C61U.SI)

$CapitaLand(C31.SI)

$CityDev(C09.SI)

$ST Engineering(S63.SI)

$SingTel(Z74.SI)

$SATS(S58.SI)

$Genting Sing(G13.SI)

Top 10 Retail Net Buy (+) Stocks

$BHG Retail Reit(BMGU.SI)

$ThaiBev(Y92.SI)

$HongkongLand USD(H78.SI)

$Keppel Corp(BN4.SI)

$Sembcorp Ind(U96.SI)

$Sembcorp Marine(S51.SI)

$OCBC Bank(O39.SI)

$YZJ Shipbldg SGD(BS6.SI)

$Yanlord Land(Z25.SI)

$First Reit(AW9U.SI)

$BHG Retail Reit(BMGU.SI)

$ThaiBev(Y92.SI)

$HongkongLand USD(H78.SI)

$Keppel Corp(BN4.SI)

$Sembcorp Ind(U96.SI)

$Sembcorp Marine(S51.SI)

$OCBC Bank(O39.SI)

$YZJ Shipbldg SGD(BS6.SI)

$Yanlord Land(Z25.SI)

$First Reit(AW9U.SI)

Source of original, weekly SGX updates :

www2.sgx.com/research-education/fund-flow-reports

www2.sgx.com/research-education/fund-flow-reports

DISCLAIMER:

Hey,

All information updates, tables and charts are for informational purposes only; they are not intended for trading purposes or advice.

We do not and cannot guarantee the accuracy of the information.

Please consult your broker or financial representative to verify pricing before executing any trade.

We are not liable for any actions taken in reliance on information contained herein.

With best regards,

Martin Seah

No comments:

Post a Comment