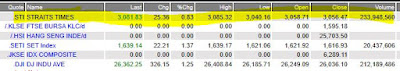

An oversold STI had an V-shape recovery which close the day +25.36 at 3081.83 points. The long bullish candle engulfed the 3 previous candles. This was the 4th day after STI had gap down lower. See charts attached

STI got back inside the pitchfork channel bottom and closed above the 5ema which has been tracking it lower. A bullish engulfing candle.

Source :

https://sginvestors.io/market/sgx-share-price-performance/straits-times-index-constituents

https://sginvestors.io/market/sgx-breakout-price-52-week-high

https://sginvestors.io/market/sgx-breakout-price-52-week-low

https://www.investingnote.com/posts/1596323#

https://sginvestors.io/market/sgx-breakout-price-52-week-high

https://sginvestors.io/market/sgx-breakout-price-52-week-low

https://www.investingnote.com/posts/1596323#

Singapore business

news

https://www.businesstimes.com.sg/stocks

https://www.straitstimes.com/business/companies-markets

https://www.theedgesingapore.com/

US Indices &

stocks performance

https://www.investing.com/indices/

https://money.cnn.com/data/fear-and-greed/

DISCLAIMER:

Hey,

All information updates, tables and charts are for informational

purposes only; they are not intended for trading purposes or advice.

We do not and cannot guarantee the accuracy of the information.

Please consult your broker or financial representative to verify pricing

before executing any trade.

We are not liable for any actions taken in reliance on information

contained herein.

With best regards,

Martin Seah

No comments:

Post a Comment