SGX Institutional and Retail Fund Flow Weekly Tracker

Week of 12 August 2019

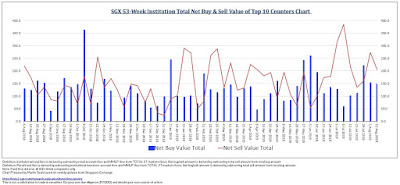

Institutional investors net sell (-S$51.9m) vs. (-S$171.7m) a week ago

Retail investors net buy (+S$188.4m) vs. (+S$271.9m) a week ago

Summary

- Last week, STI dropped 53.91 points (from 3168.94 to 3115.03), Institution investors fund flow made another new 53-week low.

- This fund out-flow / downtrend had been 9 weeks.

- As usual, retail investors buying the dip were caught by further sold down, still holding to a net-buy of +S$188.4mil of stocks for the week.

- Industrial sector had the largest out-flow again for 3 consecutive weeks.Industrial sector has 8 weeks of net-outflow already.

- Consumer Stables sector had 5 consecutive weeks of funds net-inflow. Communication Services sector had 3 weeks.

- REITS sector received the largest net-inflow SGD 44.0 mil.

- Last week, STI dropped 53.91 points (from 3168.94 to 3115.03), Institution investors fund flow made another new 53-week low.

- This fund out-flow / downtrend had been 9 weeks.

- As usual, retail investors buying the dip were caught by further sold down, still holding to a net-buy of +S$188.4mil of stocks for the week.

- Industrial sector had the largest out-flow again for 3 consecutive weeks.Industrial sector has 8 weeks of net-outflow already.

- Consumer Stables sector had 5 consecutive weeks of funds net-inflow. Communication Services sector had 3 weeks.

- REITS sector received the largest net-inflow SGD 44.0 mil.

Top 10 Institution Net Buy (+) Stocks

$SGX(S68.SI)

$SingTel(Z74.SI)

$ThaiBev(Y92.SI)

$CapitaCom Trust(C61U.SI)

$CapitaMall Trust(C38U.SI)

$Frasers L&I Tr(BUOU.SI)

$Mapletree Log Tr(M44U.SI)

$Venture(V03.SI)

$NetLink NBN Tr(CJLU.SI)

$Keppel Reit(K71U.SI)

$SGX(S68.SI)

$SingTel(Z74.SI)

$ThaiBev(Y92.SI)

$CapitaCom Trust(C61U.SI)

$CapitaMall Trust(C38U.SI)

$Frasers L&I Tr(BUOU.SI)

$Mapletree Log Tr(M44U.SI)

$Venture(V03.SI)

$NetLink NBN Tr(CJLU.SI)

$Keppel Reit(K71U.SI)

Top 10 Institution Net Sell (-) Stocks

$OCBC Bank(O39.SI)

$UOB(U11.SI)

$YZJ Shipbldg SGD(BS6.SI)

$Keppel Corp(BN4.SI)

$ComfortDelGro(C52.SI)

$Mapletree NAC Tr(RW0U.SI)

$SIA(C6L.SI)

$DBS(D05.SI)

$Wilmar Intl(F34.SI)

$ST Engineering(S63.SI)

$OCBC Bank(O39.SI)

$UOB(U11.SI)

$YZJ Shipbldg SGD(BS6.SI)

$Keppel Corp(BN4.SI)

$ComfortDelGro(C52.SI)

$Mapletree NAC Tr(RW0U.SI)

$SIA(C6L.SI)

$DBS(D05.SI)

$Wilmar Intl(F34.SI)

$ST Engineering(S63.SI)

Source of original, weekly SGX updates : https://www2.sgx.com/research-education/fund-flow-reports

InvestingNote post : https://www.investingnote.com/posts/1588285#

DISCLAIMER:

Hey,

All information updates, tables and charts are for informational purposes only; they are not intended for trading purposes or advice.

With best regards,

Martin Seah

No comments:

Post a Comment