STI climbed back above its curent uptrend line. Friday mornng is finding itself now above cloud and current consolidation zone, as well as its 200ma.

3,222.990

+1.32 (0.04%)

| Name | Prev | Last | +/- | % | High | Low |

| STRAITS TIMES | 3221.67 | 3222.99 | +1.320 | 0.0 | 3222.99 | 3205.99 |

Singapore shares end flat in listless Thursday session

26 Dec 2019 18:28

By Navin Sregantan

TRADING in the Asia-Pacific remained relatively subdued as some markets remained closed, traders were on holiday, and accounts were closed for the year.

While Singapore equities returned to trading on Boxing Day, investors appeared to be nursing a festive hangover, contributing to a session that lacked direction. The Straits Times Index (STI) was little changed, adding 1.32 points or 0.04 per cent to end Thursday at 3,222.99.

But that should have surprised few, especially at year's end.

"With low volumes across financial markets globally at the moment, significant moves at this time of the year should always be taken with a grain of salt," Oanda's Asia-Pacific senior market analyst Jeffrey Halley said.

"Volatility will only spike if we get some unexpected headlines on the geopolitical front."

Singapore shares end flat in listless Thursday session

26 Dec 2019 18:28

By Navin Sregantan

TRADING in the Asia-Pacific remained relatively subdued as some markets remained closed, traders were on holiday, and accounts were closed for the year.

While Singapore equities returned to trading on Boxing Day, investors appeared to be nursing a festive hangover, contributing to a session that lacked direction. The Straits Times Index (STI) was little changed, adding 1.32 points or 0.04 per cent to end Thursday at 3,222.99.

But that should have surprised few, especially at year's end.

"With low volumes across financial markets globally at the moment, significant moves at this time of the year should always be taken with a grain of salt," Oanda's Asia-Pacific senior market analyst Jeffrey Halley said.

"Volatility will only spike if we get some unexpected headlines on the geopolitical front."

Elsewhere in the region, China, Japan and South Korea ended higher. Taiwan and Malaysia were flat.

Of the lot, China's Shanghai Composite Index put in the strongest performance, advancing 25.47 points or 0.9 per cent to 3,007.35. The Shanghai benchmark was lifted by Beijing's plan to support the Chinese economy through fiscal stimulus. Residency curbs are also expected to be relaxed to stimulate spending.

Australia and Hong Kong were closed but both will resume trading on Friday.

Trading volume in Singapore clocked in at 1.10 billion securities. Meanwhile, total turnover stood at S$437.53 million.

Across the market, advancers trumped decliners 197 to 131. Eight of the benchmark's 30 counters ended in the red.

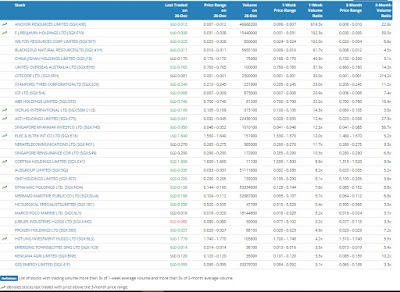

Yangzijiang Shipbuilding continued to be the most actively traded among STI counters for a third successive session. Shares in China's largest non-state shipbuilder dipped two Singapore cents or 1.7 per cent to S$1.13 with 24.8 million shares changing hands.

Rigmaker Sembcorp Marine added S$0.03 or 2.3 per cent to S$1.31 after announcing early Thursday that it has secured two offshore platform contracts worth over S$550 million to fabricate platforms at two oilfields - one in Qatar and the other off the Danish north sea.

Among pennies, Dyna-Mac Holdings built on its strong run on Christmas Eve, adding 1.5 Singapore cents or 10.5 per cent to close at 15.8 cents on Boxing Day. Thursday's session was the second consecutive time that saw substantially higher activity for the counter. This week, the offshore oil and gas contractor has gained 19.7 per cent, and after Thursday's close, is trading at over a two-and-a-half-year high.

Broadway Industrial Group continued to see a hive of activity, climbing S$0.02 or 15.9 per cent to close at 14.6 cents with 118.1 million shares traded, the most on the Singapore bourse. Like Dyna-Mac, Broadway is trading at the highest in more than two-and-a-half years.

The company, which manufactures precision-machined components and assemblies among others, has been in discussions with two prospects for possible merger and acquisition (M&A) transactions as part of its ongoing strategic review. Since Broadway revealed that it is part of M&A talks on Nov 29, its share price has jumped by 3.3 times.

Source: Business Times Breaking News