3,174.190 +14.40 (0.46%)

| |||

Singapore shares add 0.5% as risk appetite rises on trade deal hopes

05 Dec 2019 18:22

By Navin Sregantan

ASIAN equity markets were in a cheery mood after news reports indicated that the final details of the US-China "Phase One" trade deal could be ironed out by the end of the following week.

With markets preoccupied with developments on this front, it was of little to no surprise investor appetite for risk assets picked up.

In Singapore, the Straits Times Index (STI) saw broad gains, regaining Wednesday's losses to end the trading session at 3,174.19, an advance of 14.40 points or 0.5 per cent.

Singapore shares add 0.5% as risk appetite rises on trade deal hopes

05 Dec 2019 18:22

By Navin Sregantan

ASIAN equity markets were in a cheery mood after news reports indicated that the final details of the US-China "Phase One" trade deal could be ironed out by the end of the following week.

With markets preoccupied with developments on this front, it was of little to no surprise investor appetite for risk assets picked up.

In Singapore, the Straits Times Index (STI) saw broad gains, regaining Wednesday's losses to end the trading session at 3,174.19, an advance of 14.40 points or 0.5 per cent.

Elsewhere in the Asia-Pacific, benchmark indices fared similarly well, with Australia, China, Hong Kong, Japan, Malaysia and Taiwan all posting gains. Swimming against the tide was South Korea.

When US President Donald Trump said a trade deal may only be signed after November 2020's presidential election, triggering equity sell-offs, Oanda Asia-Pacific senior market analyst Jeffrey Halley was wondering on Wednesday if Mr Trump referred to a mini or comprehensive deal.

"He appears to have been referring to the latter, as persons, 'close to the talks', said overnight, that talks on an interim trade agreement with China were on the home stretch," Mr Halley said on Thursday.

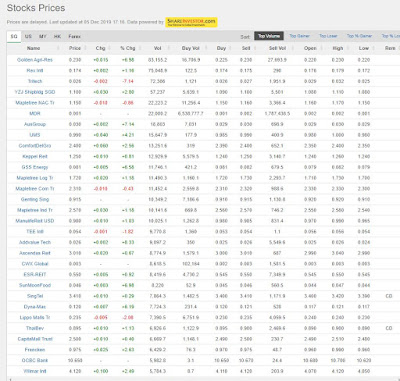

In Singapore, trading volume stood at 915.62 million securities, 79 per cent of the daily average in the first 10 months of 2019. Total turnover clocked in at S$965.91 million, 92 per cent of the January-to-October daily average.

Across the market, advancers trumped decliners 216 to 145. Of the STI's 30 counters, just four were in the loss column.

Golden Agri-Resources continued to see heavy trading since being dropped off from the MSCI Singapore Index. With 83.2 million shares traded, the agribusiness firm remained the STI's most active counter, ending the session 1.5 Singapore cents or 7 per cent higher at S$0.23.

Among real estate investment trusts (Reits), Manulife US Reit edged up one US cent or 1 per cent to close at US$0.98 after announcing that it will be included in the FTSE EPRA Nareit Index from Dec 23.

With its inclusion in the real estate index, Manulife US Reit units are likely to see higher trading liquidity and visibility as institutional investors and fund managers will be placing more attention on the US-focused office property play.

Singapore Exchange market strategist Geoff Howie noted: "Since listing in May 2016, Manulife US Reit has grown its US commercial portfolio from three properties with aggregate net leasible area (NLA) of 1.8 million square feet to nine properties with aggregate NLA of 4.7 million sq ft with assets under management now at S$2.1 billion."

Meanwhile, Mapletree North Asia Commercial Trust's (MNACT) units dipped one Singapore cent or 0.9 per cent to S$1.15 after saying it would be acquiring a 98.5 per cent stake for S$482.5 million in two Tokyo office properties from its sponsor.

Disclaimer:

Hey, All information updates, tables and charts are for informational purposes only; they are not intended for trading purposes or advice.

We do not and cannot guarantee the accuracy of the information.

Please consult your broker or financial representative to verify pricing before executing any trade.

We are not liable for any actions taken in reliance on information contained herein.

With best regards,

Martin

Hey, All information updates, tables and charts are for informational purposes only; they are not intended for trading purposes or advice.

We do not and cannot guarantee the accuracy of the information.

Please consult your broker or financial representative to verify pricing before executing any trade.

We are not liable for any actions taken in reliance on information contained herein.

With best regards,

Martin

No comments:

Post a Comment