It did a double bottomed at day low, 3,182.05 level to par 11.87 points of losses.

3,193.920 -6.69 (-0.21%)

| |||

Singapore shares continue slide on Friday, down 1% on the week

29 Nov 2019 18:13

By Navin Sregantan

With the US market closed for Thanksgiving and no updates from the US-China trade front, investor worries were left to linger in silence over China's possible reaction to the Hong Kong pro-democracy bill being passed in the US.

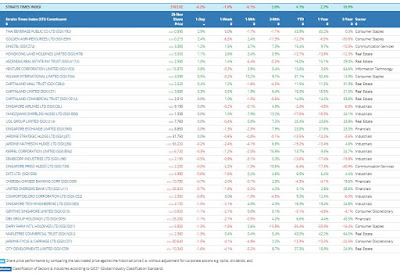

Singapore's Straits Times Index (STI) extended losses from the previous session but fared better than most of its regional peers to finish at 3,193.92, easing 6.69 points or 0.2 per cent.

On the week, the blue-chip index dipped 31.73 points or 1 per cent from last Friday's close of 3,225.65. The STI lost 35.96 points or 1.1 per cent in November.

Elsewhere in the Asia-Pacific, markets were splattered in red with Australia, China, Hong Kong, Japan, Malaysia, South Korea and Taiwan all posted losses.

Of the lot, the Hang Seng fared worst, dropping 547.24 points or 2 per cent to close at 26,346.49.

On market performance on Friday, AxiTrader chief Asia market strategist Stephen Innes observed: "There are far too many combinations of headline risk to navigate, which for today's session, is bringing about a bit of randomness amid sparse liquidity as traders appear to be flattening out long risk positions."

He felt market participants were likely to have gotten "a tad jittery" about ending November with no mini deal in place and little idea of when trade talks will take place next.

Traders will be hoping for some progress before Christmas, especially since US$160 billion of tariffs on Chinese goods are due to kick in on Dec 15.

Wall Street's closure meant that markets in Asia saw thin trading to close out the week. In Singapore, trading volume stood at 1.05 billion securities, 91 per cent of the daily average in the first 10 months of 2019. Meanwhile, total turnover clocked in at S$1.24 billion, 18 per cent over the January-to-October daily average.

Across the market, decliners outpaced advancers 188 to 167. Half of the benchmark's 30 counters were in the red.

With 99.7 million shares changing hands, Golden Agri-Resources was the STI's most active counter. It added 0.5 Singapore cent or 2.4 per cent to 21.5 cents.

Rumours that Thai Beverage is speaking with advisers about a listing of its brewing business in Singapore, saw its shares trade up to 5 per cent higher before trading was halted shortly after the commencement of the later session. The food and beverage giant's shares last traded 2.5 Singapore cents or 2.9 per cent higher at S$0.89.

Citing sources, Bloomberg wrote that ThaiBev may seek to value the unit at as much as US$10 billion.

Accordia Golf Trust units surged on Friday after it received a non-binding proposal from an unidentified party, which might result in the trust selling its interests in all of its golf courses.

Trading on a cum-dividend basis, Accordia closed S$0.10 or 16.7 per cent up to S$0.70.

Local tech listings were another bright spot on Friday. AEM Holdings advanced S$0.09 or 5.3 per cent to S$1.80 after DBS initiated coverage on the test handler with a "Buy" recommendation. Meanwhile, UMS Holdings added S$0.015 or 1.7 per cent to S$0.905 and the STI's Venture Corp gained S$0.12 or 0.8 per cent to S$15.87.

Source: Business Times Breaking News

No comments:

Post a Comment