On the hourly chart, we witnessed that STI has closed on its parallel channel bottom.

On the dail chart, as pointed out by a fame top trading-broker that STI had actaully tested the parallel channel top resistance last Friday before pulling back.

On the weekly chart, STI has reached the bottom of its previous consolidation top so the resistance can be felt.

2,528.760 +41.20 (1.66%)

| |||

STI finishes week at 2,528.76, up 4.9%

27 Mar 2020 17:37

By Marissa Lee

Singapore stocks closed higher on Friday, a day after the government announced a S$48 billion relief package to cushion the impact of the Covid-19 pandemic.

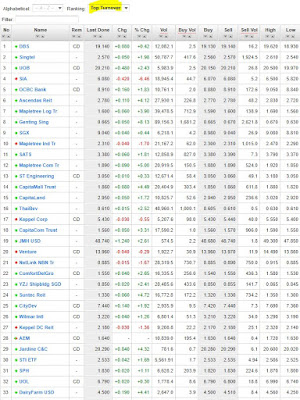

The Straits Times Index (STI) gained 1.66 per cent or 41.20 points to close at 2,528.76, finishing the week up 118.02 points or 4.9 per cent.

About 1.35 billion securities worth S$1.92 billion changed hands. Gainers outnumbered losers 329 to 147.

Genting Singapore was the the most active counter, rising five Singapore cents or 8.13 per cent to S$0.665. Analysts estimated that Resorts World Sentosa would reap cost savings of between S$70 million and S$180 million from wage support and property-tax rebates.

Singapore Airlines was the top loser, falling 42 Singapore cents or 6.46 per cent to S$6.08 following its announcement of an S$8.8 billion cash call, including the issuance of S$3.5 billion in mandatory convertible bonds (MCBs).

Maybank Kim Eng wrote: ?The latest capital raising came as no surprise to the market and should help shore up its cash flow position while enabling it to meet its ongoing financial commitment, despite a significant decline in passenger revenue. However, the massive MCBs will create a formidable overhang on the stock for years to come.?

Jardine Matheson was the top gainer, rising US$1.24 or 2.61 per cent to US$48.74.

Regional markets also closed higher on Friday, with the Hang Seng up 0.56 per cent and the KLSE up 1.13 per cent, following overnight gains in US markets.

Source: Business Times Breaking News

Source and recommended reads

https://sginvestors.io/market/sgx-share-price-performance/straits-times-index-constituents

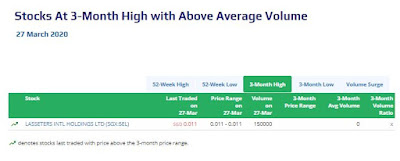

https://sginvestors.io/market/sgx-breakout-price-3-month-high-volume-above-average

https://sginvestors.io/market/sgx-breakout-price-3-month-low-volume-above-average

https://sginvestors.io/market/sgx-top-short-sell-by-value

https://sginvestors.io/market/sgx-top-short-sell-by-volume

https://www.investingnote.com/posts/1852141

Singapore business news

https://www.businesstimes.com.sg/stocks

https://www.straitstimes.com/business/companies-markets

https://www.theedgesingapore.com/

US Indices & stocks performance

https://www.investing.com/indices/

https://money.cnn.com/data/fear-and-greed/

DISCLAIMER:

Hello,

All information updates, tables and charts are for informational purposes only; they are not intended for trading purposes or advice.

We do not and cannot guarantee the accuracy of the information.

Please consult your broker or financial representative to verify pricing before executing any trade.

We are not liable for any actions taken in reliance on information contained herein.

With best regards,

Martin

No comments:

Post a Comment