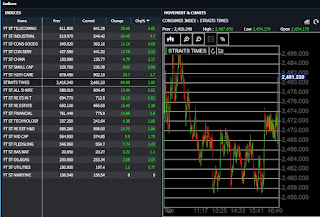

STI re-tested its current downtrend line today and it closed just right below it.

2,481.230 +64.99 (2.69%)

| |||

31 Mar 2020 18:16

By Navin Sregantan

Singapore's Straits Times Index (STI) closed higher on Tuesday after official Chinese factory data for March beat expectations, lifting sentiment at the tail end of a quarter that will go down as one to forget due to the Covid-19 outbreak.

In contrast to the majority of sessions in the past two months, trading was calm. The local benchmark was more than 2 per cent up from the opening bell in the morning session, and it stayed that way for most of the session to finish 64.99 points or 2.7 per cent higher at 2,481.23 with four of 30 counters ending in the red.

For Q1, the STI's 23 per cent decline is its worst quarterly performance since the October-December quarter of 2008.

Elsewhere in the Asia-Pacific, equity benchmarks in China, Hong Kong, Malaysia, South Korea and Taiwan were higher. Australia closed lower after investors booked profits following Monday's record showing; Japan also closed lower.

The data from China may have pointed to expansion in manufacturing and services activity, but the economic effects of the virus outbreak are likely to remain for the rest of the year.

UOB economist Ho Woei Chen said that it would be "difficult to conclude" from Tuesday's readings whether China is "now back in a business-as-usual environment".

"Looking ahead, we continue to expect a contraction in China?s Q1 2020 gross domestic product by 3.4 per cent year-on-year (y-o-y), when the data is released on April 17. From there, we expect the economy to recover to 5.7 per cent y-o-y in Q2 2020," she said.

Among STI counters, Genting Singapore was the most traded counter with 89.3 million shares changing hands. The casino operator advanced S$0.05 or 7.8 per cent to S$0.69.

Following last Thursday's supplementary budget by the Singapore government, CGS-CIMB head of research Lim Siew Khee said Genting could achieve between S$70 million and S$171 million in cost savings in FY2020 due to the enhanced Job Support Scheme and property tax rebates.

"We await further reconfirmation of such cost savings from management, but are positive that the measures could cushion the impact from the significant reduction in tourist flows," she wrote.

Singtel was another active, closing S$0.12 or 5 per cent higher at S$2.54 on 56.4 million shares traded. According to reports in Australia, the telco?s Australian unit Optus could be selling its telecommunications tower portfolio for A$2 billion (S$1.76 billion).

Citi Research analyst Arthur Pineda said that "a move to sell the assets could serve to free up cash for Singtel. This, in turn, could allow it to comfortably sustain its current 17.5 cent-per-share payout into FY21 and/or accelerate capex for 5G services".

Land transport company ComfortDelGro closed S$0.04 or 2.7 per cent higher at S$1.52. ComfortDelGro, which indicated on Monday that its taxi segment could record a loss in FY2020, is down 36 per cent this year. DBS Group Research analyst Andy Sim said that the market has priced in the "dire outlook" but pointed out that "there are limited re-rating catalysts at this juncture".

Among companies in the second line, Biolidics shares jumped S$0.05 or 22.7 per cent up at S$0.27. After the market close on Monday, the Catalist-listed cancer-diagnostics company said it is set to launch a rapid test kit for Covid-19 in April.

Across the Singapore market, advancers outpaced decliners 294 to 152, with 1.34 billion securities valued at S$1.93 billion changing hands.

Source: Business Times Breaking News

No comments:

Post a Comment