On the day chart, it retraced back during the last 2 trading hours under its triangle top resistance after spending there for 2 hours.

2,612.250 +6.69 (0.26%)

| |||

STI up 0.3%, Covid-19 continues to dent investor sentiment

16 Apr 2020 17:41

By Claudia Tan

The Straits Times Index ended Thursday up 6.69 points or 0.3 per cent at 2,612.25 points.

The blue-chip index rebounded slightly by afternoon after opening lower on the back of overnight losses on Wall Street and Europe.

Elsewhere in Asia, Malaysia, Hong Kong and Japan ended lower as the pandemic continues to weigh on investor sentiment.

?The risk-off atmosphere engulfed markets once again as global coronavirus cases climbed to two million, with the trail of carnage to show in the form of the latest economic and earnings data,? said IG market strategist Pan Jingyi.

The earlier cheer from the better-than-expected Chinese data had worn off by Wednesday, following a series of ?disappointing US data, soft earnings numbers and slump in crude oil prices?, she said.

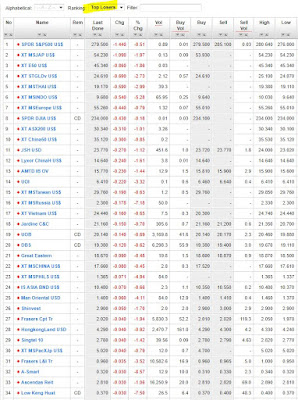

Across the Singapore market, advancers outpaced decliners 248 to 187 for the day, with 1.22 billion shares worth S$1.25 billion changing hands.

The best performer among the index?s constituents was Yangzijiang Shipbuilding, which gained S$0.03 or 3.0 per cent to S$1.03.

The banking trio were among the nine index counters that ended in the red. DBS and UOB shed 0.6 per cent to S$19.38 and 0.7 per cent to S$20.14 respectively; OCBC fell 0.3 per cent to S$8.87.

The most heavily traded stock was Genting Singapore, which closed at 75.5 Singapore cents, gaining S$0.01 or 1.3 per cent.

Outside the STI constituents, agri-food company Japfa emerged as one of the top gainers. Japfa shares jumped S$0.05 or 9.8 per cent to S$0.56, following an announcement the previous night that it is looking to sell a 25-per-cent stake in its China dairy business to Japanese conglomerate Meiji for some US$254.4 million.

Source: Business Times Breaking News

Source and recommended reads

https://sginvestors.io/market/sgx-share-price-performance/straits-times-index-constituents

https://sginvestors.io/market/sgx-breakout-price-3-month-high-volume-above-average

https://sginvestors.io/market/sgx-breakout-price-3-month-low-volume-above-average

https://www.investingnote.com/posts/1852141

Singapore business news

https://www.businesstimes.com.sg/stocks

https://www.straitstimes.com/business/companies-markets

https://www.theedgesingapore.com/

DISCLAIMER:

Hello,

All information updates, tables and charts are for informational purposes only; they are not intended for trading purposes or advice.

We do not and cannot guarantee the accuracy of the information.

Please consult your broker or financial representative to verify pricing before executing any trade.

We are not liable for any actions taken in reliance on information contained herein.

With best regards,

Martin

No comments:

Post a Comment