DJIA up 33.33 (0.14%) to close at 23537.69, near day high.

- It back-tested its previous gap resistance for the 2nd day.

- Today it went lower than yesterday's day low (23233) to rebound from today's day low of 23211. So it was like yesterday which had closed another bullish hammer.

SP500 up 16.19 (0.58%) to close at 2799.56, which was slightly higher then its open price level.

- It also back-tested its resistance-turned support zone for the 2nd day (day low today at 2764.32). Yesterday. it closed a red hammer. Today, it closed a green long-tail Doji.

VIX down 1.79% to close near day low at 40.11.

- The volatility index had a volatle session itself ranging from 39.87 to 43.02.

Nasdaq up 139.19 points (1.66%) to close at 8532.36.

- It rebounded off it up channel top resistance. This was the 3rd day Nasdaq was able to hold itself from dropping back inside the channel.

Small cap Russell 2000 down 5.888 points (-0.50%) to close at 1178.089.

- It closed a bullish-looking red, long-tail pin bar. Its day low was at 1154.52 points.

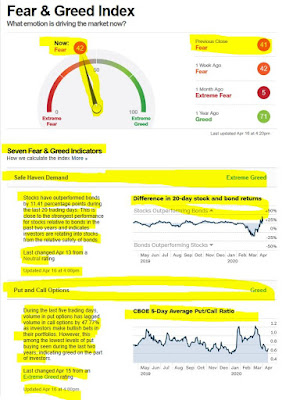

Fear & Greed Index : 42 (Fear) vs 41 (fear) the day before.

Important notes :

1. The Safe Haven Demand indicator has alrady changed to Extreme Greed on 13the Apr (Monday).

2. On the other hand, the Put and Call Options indicator has simmered down from Extreme Greed to Greed on 15th Apr (Wednesday) as the broad market indices back-tested its resistance-turned support zones.

Stocks - Dow Cuts Losses as Traders Eye Trump Update on Reopening Economy

By Yasin Ebrahim

Investing.com – The Dow cut its losses and ended higher Thursday, shrugging off a surge in jobless claims as investors awaited an update from President Donald Trump on the prospect of reopening the economy, even as several states extended lockdown measures.

Trump is set to detail guidelines for opening up America again in a news conference at 6 PM ET (2200 GMT). The press conference comes as the president has recently claimed "ultimate authority" on making the call to restart the economy, much to the bemusement of several governors, including New York Governor Andrew Cuomo.

Cuomo, as well as several other governors of Northeastern states, agreed to extended current lockdown measures into mid-May.

The lockdown measures across the country to stem the Covid-19 pandemic have wreaked havoc on the economy, particularly in the labor market, as shuttered businesses have led to a surge in unemployment claims.

Jobless claims surged by 5.2 million last week, the Labor Department reported Thursday, taking the four-week total to 22 million, wiping out nearly all of the 22.442 million jobs created since November 2009.

In manufacturing, the Philadephia Fed's manufacturing index fell to a reading of -56.6, the lowest reading since reading since July 1980.

The gloomy economic background was reflected in the earnings seen so far this week from Wall Street banks.

Morgan Stanley (NYSE:MS) ended down 0.1% after reporting a 30% drop in profit, adding to a string of poor quarterly results from Wall Street banks, including JPMorgan Chase (NYSE:JPM), Wells Fargo (NYSE:WFC) and Citigroup (NYSE:C), showing steep declines in profit.

BlackRock (NYSE:BLK), meanwhile, rose 3.5%, even as the asset manager reported that funds under management fell below $7 trillion after profit slumped 23%.

Just days after agreeing a $50 billion bailout package with the Treasury, airline stocks slumped sharply amid concerns the sector is set for a long road to recovery.

"I don’t think air travel will snap right back to where it was here this year, maybe it will come back next year," said Southwest CEO Gary Kelly. "If this is a real recession and a bad recession, it could take four or five years."

United Airlines (NASDAQ:UAL) fell 11%, American Airlines (NASDAQ:AAL) dropped 10% and Southwest Airlines (NYSE:LUV) slipped 6.5%.

Tech, however, was up sharply thanks to a surge in chip stocks underpinned by encouraging quarterly results from chip bellwether Taiwan Semiconductor Manufacturing (NYSE:TSM).

For the quarter, Taiwan Semi reported earnings and revenue that topped analysts' consensus estimates.

Netflix (NASDAQ:NFLX) was also in the spotlight as the streaming device maker is expected to report a jump in new users amid a favorable backdrop as more people turn to streaming giant to pass the time during the government-imposed lockdown measures. Shares rose nearly 3%.

Source https://www.investing.com/markets/united-states

https://www.investing.com/indices

https://www.finviz.com

https://money.cnn.com/investing/about-fear-greed-tool/index.html

https://money.cnn.com/data/fear-and-greed

https://www.investing.com/indices

https://www.finviz.com

https://money.cnn.com/investing/about-fear-greed-tool/index.html

https://money.cnn.com/data/fear-and-greed

DISCLAIMER:

Hello,

All information updates, tables and charts are for informational purposes only; they are not intended for trading purposes or advice.

We do not and cannot guarantee the accuracy of the information.

Please consult your broker or financial representative to verify pricing before executing any trade.

We are not liable for any actions taken in reliance on information contained herein.

With best regards,

Martin

All information updates, tables and charts are for informational purposes only; they are not intended for trading purposes or advice.

We do not and cannot guarantee the accuracy of the information.

Please consult your broker or financial representative to verify pricing before executing any trade.

We are not liable for any actions taken in reliance on information contained herein.

With best regards,

Martin

No comments:

Post a Comment