Tuesday, 2nd July 2019

THE BUSINESS TIMES - "Singapore shares end flat on Tuesday on profit-taking, growth concerns

Investors preferred to book profits as the case for a fading global outlook was beefed up by disappointing economic data from the US and China. The Straits Times Index (STI) finished 1.46 points or 0.04 per cent lower at 3,370.80.

IG market strategist Pan Jingyi told The Business Times that in the early session, the STI was "being suppressed on profit-taking and the revival of concerns on trade tensions and their implications on economic performance"...

... In Singapore, trading volume clocked in at 1.05 billion securities, 88 per cent of the daily average in the first five months of 2019. Total turnover came to S$973.56 million, 93 per cent of the January-to-May daily average..."

|

| STI tested its bull chanel extension top for the 2nd day today, leaving a long lower wick, a bearish Hanging man candlestick. |

|

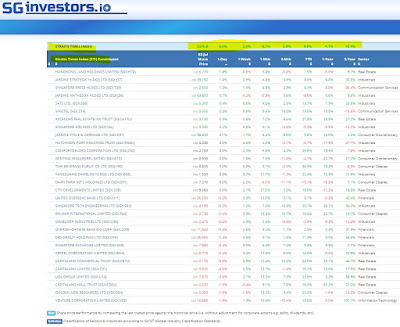

| https://sginvestors.io/market/sgx-share-price-performance/straits-times-index-constituents |

|

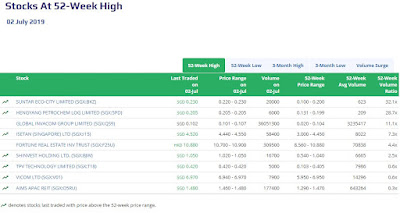

| https://sginvestors.io/market/sgx-breakout-price-52-week-high |

|

| https://sginvestors.io/market/sgx-breakout-price-52-week-low |

Hey,

All information updates, tables and charts are for informational purposes only; they are not intended for trading purposes or advice.

We do not and cannot guarantee the accuracy of the information.

Please consult your broker or financial representative to verify pricing before executing any trade.

We are not liable for any actions taken in reliance on information contained herein.

With best regards,

Martin Seah

No comments:

Post a Comment