SGX Institutional and Retail Fund Flow Weekly Tracker

Week of 15 July 2019

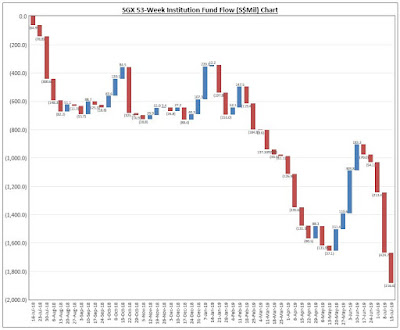

Institutional investors net sell (-S$216.6m) vs. (-S$424.7m) a week ago

Retail investors net sell (-S$111.5m) vs. (-S$67.1m) a week ago

Summary

- As Singapore's Straits Times Index (STI) closed the week higher at 3377.96, which was the highest since peaking in April'19, Institution investor had been net-selling for the 5th consecutive weeks already.

- The Market Maker / Liquidity Provider have been absorbing the heavy selling from both the Institution and the Retail investors. FYI that the week before Institution investors / traders MADE THE LARGEST WEEKLY WITHDRAWAL IN 53 WEEKS at (-S$424.7m).

- Institutions took profit from REITS, Real Estate and Industrial and Communication Services as they distributed at high.

- Financials led the Institution funds addition after leading the decline for 3 consecutive week, with DBS led the Top net-buy list.

Top 10 Institution Net Buy (+) Stocks

$DBS(D05.SI)

$Wilmar Intl(F34.SI)

$NetLink NBN Tr(CJLU.SI)

$JMH USD(J36.SI)

$Fortune Reit HKD(F25U.SI)

$AEM(AWX.SI)

$SingPost(S08.SI)

$Mapletree Com Tr(N2IU.SI)

$Sembcorp Marine(S51.SI)

$Hi-P(H17.SI)

$DBS(D05.SI)

$Wilmar Intl(F34.SI)

$NetLink NBN Tr(CJLU.SI)

$JMH USD(J36.SI)

$Fortune Reit HKD(F25U.SI)

$AEM(AWX.SI)

$SingPost(S08.SI)

$Mapletree Com Tr(N2IU.SI)

$Sembcorp Marine(S51.SI)

$Hi-P(H17.SI)

Top 10 Institution Net Sell (-) Stocks

$Ascendas Reit(A17U.SI)

$CapitaLand(C31.SI)

$SATS(S58.SI)

$SingTel(Z74.SI)

$SPH(T39.SI)

$Keppel Corp(BN4.SI)

$UOB(U11.SI)

$CapitaCom Trust(C61U.SI)

$Suntec Reit(T82U.SI)

$OCBC Bank(O39.SI)

$Ascendas Reit(A17U.SI)

$CapitaLand(C31.SI)

$SATS(S58.SI)

$SingTel(Z74.SI)

$SPH(T39.SI)

$Keppel Corp(BN4.SI)

$UOB(U11.SI)

$CapitaCom Trust(C61U.SI)

$Suntec Reit(T82U.SI)

$OCBC Bank(O39.SI)

Source of Original, weekly SGX updates :

www2.sgx.com/research-education/fund-flow-reports

$STI(^STI.IN)

DISCLAIMER:

Hey,

All information updates, tables and charts are for informational

purposes only; they are not intended for trading purposes or advice.

We do not and cannot guarantee the accuracy of the information.

Please consult your broker or financial representative to verify pricing

before executing any trade.

We are not liable for any actions taken in reliance on information

contained herein.

With best regards,

Martin Seah

No comments:

Post a Comment