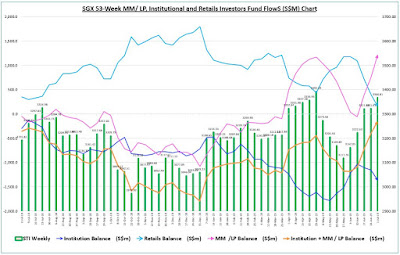

SGX Institutional and Retail Fund Flow Weekly Tracker

Week of 1 July 2019

Institutional investors net sell (-S$213.4m) vs. (-S$54.1m) a

week ago

Retail investors net sell (-S$250.2m) vs. (-S$322.3m) a week ago

Summary

- As Singapore's Straits Times Index (STI) closed the week at 3,366.81 up 45.20 points (1.4%) from the week before, Institution investors / traders withdrew for the 3rd consecutive week at (-S$213.4m), the largest amount in 3 months.

- Communication Services (S$M) continued attract positive fund inflow for 10 consecutive weeks, with the latest weekly addition at only S$2.8mil, which was a sharp drop from S$80.0mil, the week before. You might want to know that $SingTel(Z74.SI) made it into the top Net-selling counters last week after 8 weeks in the Top10 Net-buying list.

- Financial sector led the largest decline for the 2nd week at S$222.1mil, which was even more than the net value of S$213.4mil, led by $DBS(D05.SI) , $OCBC Bank(O39.SI) and $UOB(U11.SI) .

- REITS and Trust counters received the most funds, rotated out from other sectors as 6 of its counters made it into Top 10 net-buy counters. - Real Estate (excl. REITs*) sector came in 2nd with Institution fund inflow turned hugely positive after 2 weeks decline, led by $CapitaLand(C31.SI).

Top

10 Institution Net Buy (+) Stocks (S$M)

Top

10 Institution Net Sell (-) Stocks (S$M)

|

| Chart of the week |

DISCLAIMER:

Hey,

All information updates, tables and charts are for informational purposes only; they are not intended for trading

purposes or advice.

We do not and cannot guarantee the accuracy of the information.

Please consult your broker or financial representative to verify pricing before executing any trade.

We are not liable for any actions taken in reliance on information contained herein.

With best regards,

Martin Seah

No comments:

Post a Comment