Singapore's Straits Times Index (STI) closed at 3,366.81, down 5.44 points or 0.2 per cent on Friday. On the week, the benchmark index is up 45.20 points or 1.4 per cent from last Friday's close of 3,321.61.

... "If Friday's non-farm payroll report comes in with a big miss, it might catalyse some short US dollar activities as it not only signals weakness in the fundamentals, but will also urge the Fed to take on accommodative monetary policies. On the other hand, if the jobs data beats expectations and is on the upside, the reverse is likely to happen and the US dollar may jump," CMC Markets analyst Margaret Yang said..."

Read more:https://www.businesstimes.com.sg/stocks/singapore-shares-dip-on-friday-up-14-on-the-week

|

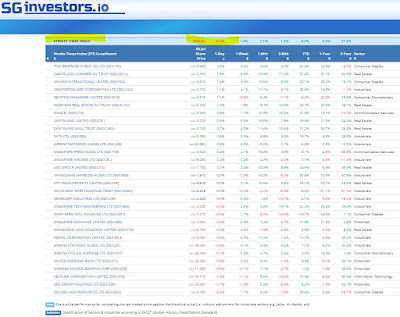

| https://sginvestors.io/market/sgx-share-price-performance/straits-times-index-constituents |

DISCLAIMER:

Hey,

All information updates, tables and charts are for informational purposes only; they are not intended for trading purposes or advice.

We do not and cannot guarantee the accuracy of the information.

Please consult your broker or financial representative to verify pricing before executing any trade.

We are not liable for any actions taken in reliance on information contained herein.

With best regards,

Martin Seah

No comments:

Post a Comment