It then started to plunge lower at rapidly to reach the bottom of the 1st pull back level, 3144.10.

It rebounded very firmly, 45degree up in the min chart to close at 3181.25.

Day high was 3190.08, which is the the bottom level of the demand zone.

STI closed a long tailed Spinning Top candlestick above it previous consolidation zone, with a bullish hint.

But, will there be a follow through for the next 4 trading days this week.

Watch

3,181.250 -58.77 (-1.81%)

| |||

Singapore shares tumble 1.8% on widening Wuhan virus fears

28 Jan 2020 18:26

By Navin Sregantan

IT WASN'T much of a "welcome back" for the local equity market, which faced a vicious sell-off on its return from the Chinese New Year (CNY) holiday.

Over the weekend, deaths from the Wuhan coronavirus tripled and confirmed cases doubled, presenting a worrying picture for many investors both here and the region. Fears were also exacerbated by the World Health Organization raising the global risk level of the virus to "high" despite it being confident in China's ability to control the spread.

"With coronavirus worries on the rise, the market continues to struggle with the unenviable task of factoring in absolute terms its implied economic devastation," said Stephen Innes, AxiTrader's chief Asia market strategist.

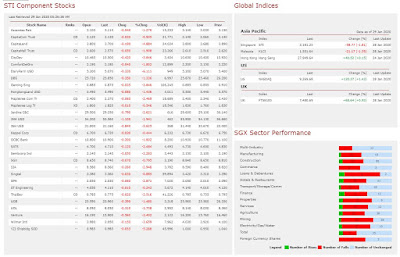

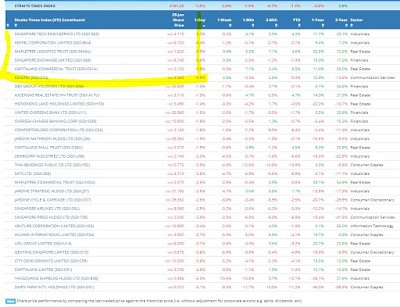

In Singapore, where seven cases of the virus have been confirmed, the Straits Times Index (STI) opened sharply lower. The blue-chip index traded lower by as much as 2.9 per cent before recovering slightly to end at 3,181.25, giving up 58.77 points or 1.8 per cent.

Elsewhere in the region, benchmarks in Australia, Japan, Malaysia and South Korea were markedly lower. China, Hong Kong and Taiwan markets remained closed for the CNY holiday.

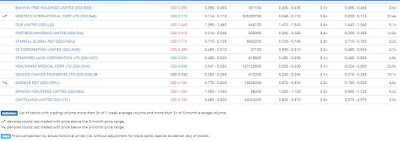

In Singapore, trading volume continued to be heavy at 2.49 billion securities, more than double the 2019 daily average, with much of the activity down to penny play. Total turnover was S$2.08 billion, 96 per cent over last year's intraday mean.

Decliners trumped advancers 400 to 98. All 30 of the benchmark's counters ended in the loss column.

With investor focus very much on the spread of the virus, attention here was on accumulation of beneficiaries of the outbreak like medical groups and rubber glove makers.

Medtecs International, a manufacturer and distributor of medical consumables, continued its run as a hotly traded stock on the Singapore Exchange (SGX). It advanced 6.8 Singapore cents or 65.4 per cent to 17.2 cents - an all-time high - with 325.2 million shares changing hands. Top Glove surged S$0.45 or 23.7 per cent to close at S$2.35.

Their gains came at the expense of listings with considerable Chinese exposure.

Sasseur Reit, which temporarily closed its four outlet malls in the Chinese cities of Chongqing, Hefei and Kunming, lost S$0.09 or 10.3 per cent to close at 78.5 cents.

Other property trusts with sizeable exposure to China also took a beating. Mapletree North Asia Commercial Trust units fell S$0.07 or 5.7 per cent to S$1.17. CapitaLand Retail China Trust (CRCT), which has a portfolio of 10 retail malls in China, dropped S$0.10 or 6.1 per cent to S$1.53.

CRCT's parent, real estate giant CapitaLand, which derives more than a third of its earnings from China, was among the biggest laggards on the STI, falling S$0.19 or 4.9 per cent to S$3.70.

Even though fears of contagion have gripped markets, Joel Ng, KGI Securities head of Singapore research, told The Business Times the growth outlook for most companies is still intact and there were some opportunities to pick up counters with attractive valuations. These include AEM Holdings (down S$0.10 or 4.7 per cent to S$2.01), CapitaLand and SGX (down S$0.07 or 0.8 per cent to S$8.74).

Source: Business Times Breaking News

Source and recommended reads :

https://sginvestors.io/market/sgx-share-price-performance/straits-times-index-constituents

https://sginvestors.io/market/sgx-breakout-price-3-month-high-volume-above-average

https://sginvestors.io/market/sgx-breakout-price-3-month-low-volume-above-average

https://www.investingnote.com/posts/1798404

https://sginvestors.io/market/sgx-breakout-price-3-month-high-volume-above-average

https://sginvestors.io/market/sgx-breakout-price-3-month-low-volume-above-average

https://www.investingnote.com/posts/1798404

Singapore business news

https://www.straitstimes.com/business/companies-markets

https://www.theedgesingapore.com/

US Indices & stocks performance

https://www.investing.com/indices/

https://money.cnn.com/data/fear-and-greed/

DISCLAIMER:

Hey,

All information updates, tables and charts are for informational purposes only; they are not intended for trading purposes or advice.

We do not and cannot guarantee the accuracy of the information.

Please consult your broker or financial representative to verify pricing before executing any trade.

We are not liable for any actions taken in reliance on information contained herein.

With best regards,

Martin

No comments:

Post a Comment