| Name | Prev | Last | +/- | % | High | Low |

| STRAITS TIMES | 3218.86 | 3247.86 | +29.000 | +0.9 | 3247.86 | 3233.5 |

Singapore shares post strong recovery, gain 0.9% on Tuesday

07 Jan 2020 18:26

By Navin Sregantan

SINGAPORE equities along with their regional counterparts reversed Monday's losses, and prices of both gold and oil pulled back as fears of reprisal by Tehran over a US airstrike killing a top Iranian commander in Baghdad temporarily receded.

"It's called Turnaround Tuesday for a reason," AxiTrader chief Asia market strategist Stephen Innes said of the early session recovery seen in the region's markets.

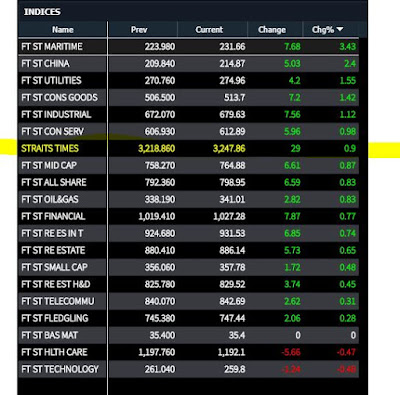

The local benchmark Straits Times Index (STI) jumped at the opening bell before holding relatively steady until the end of the session. The blue-chip index closed at 3,247.86, after an advance of 29.00 points or 0.9 per cent.

It was similar elsewhere in the Asia-Pacific, where Australia, China, Japan, Hong Kong, Malaysia and South Korea were markedly higher.

Bucking the trend was Taiwan, where the Taiex Index fell 73.04 points or 0.6 per cent to close at 11,880.32. It was weighed down by the New Taiwan dollar strengthening to a one-and-a-half-year high against the greenback.

Monday's sell-off was representative of the tendency of markets to have the memory of a goldfish. Removing US-Iran tensions from the equation, the global economy is continuing along the path of recovery and monetary policy remains accommodative - two key conditions supporting equities.

As such, traders noted there were ample opportunities to take advantage of the sell-off and buy on the dip.

"The dips in equity markets, for example, in the absence of an immediate Iran retaliation, represent better levels to get long," Oanda Asia-Pacific senior market analyst Jeffrey Halley said.

Observers are expecting more volatility this week, especially after news that Iran is assessing 13 scenarios to exact revenge in what it said would be a "historic nightmare" for the US but the big question is when.

"Iran is far too clever to be so ham-fisted in its response to the (Qasem) Soleimani assassination. A reply will come, but most likely indirectly and with plausible deniability," Mr Halley noted.

Trading volume in Singapore stood at 1.5 billion securities. Total turnover clocked in at S$1.19 billion.

Advancers trumped decliners 248 to 161. Only one out of the benchmark's 30 counters ended in the red.

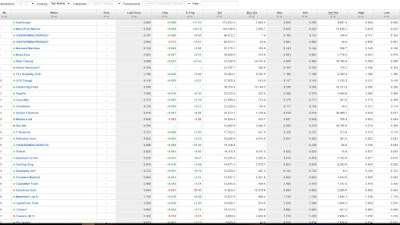

Singtel spent most of the session lower before edging up late in the day to close S$0.01 or 0.3 per cent higher at S$3.36. The telco said that fires in Australia have affected parts of Singtel subsidiary Optus' telecom network in New South Wales and Victoria.

ComfortDelGro also recovered to end S$0.02 or 0.9 per cent higher at S$2.34. On Monday, the transport operator said none of its bus services in the Australian states of New South Wales, Victoria and Queensland were directly affected by one of the worst bushfires to hit Down Under.

The local lenders notched up gains too. DBS Group Holdings added S$0.19 or 0.7 per cent to S$26.05, OCBC Bank gained S$0.08 or 0.7 per cent to S$11.00 while United Overseas Bank finished at S$26.70, advancing S$0.33 or 1.3 per cent .

Among healthcare plays, ISEC Healthcare ended flat at S$0.36 after it proposed an acquisition of an eye centre in Johor Bahru.

Source: Business Times Breaking News

No comments:

Post a Comment