3,252.000 +29.17 (0.91%)

| |||

"Singapore shares get strong start to 2020

02 Jan 2020 18:19

By Navin Sregantan

Most of the region's equity markets got the new year off to a flying start and that likely surprised few.

In the first day of trading in the new year, Singapore's Straits Times Index (STI) advanced by as much as 1 per cent before ending the session at 3,252.00, registering a gain of 29.17 points or 0.9 per cent".

Singapore shares get strong start to 2020

02 Jan 2020 18:19

By Navin Sregantan

Most of the region's equity markets got the new year off to a flying start and that likely surprised few.

In the first day of trading in the new year, Singapore's Straits Times Index (STI) advanced by as much as 1 per cent before ending the session at 3,252.00, registering a gain of 29.17 points or 0.9 per cent.

Elsewhere in the Asia-Pacific, Australia, China, Hong Kong, Malaysia and Taiwan were higher. Of the lot, the Hong Kong benchmark, the Hang Seng Index was the best performer, adding 353.77 points or 1.3 per cent to 28,543.52.

Bucking the trend was South Korea. Meanwhile, Japan remained closed but will resume trading on Friday.

Recent developments have given investors much to cheer about.

US President Donald Trump has set Jan 15 as the date both Beijing and Washington will sign a "Phase One" trade deal; the Chinese central bank has lowered its cash reserve ratio for banks in a bid to stimulate growth and inject liquidity; and the private survey of China's manufacturing sector remained healthy.

Moreover, the region's other manufactring data releases of the day pointed to "have actually quietly outperformed", which implies that some confidence was returning, Oanda's Asia-Pacific senior market analyst Jeffrey Halley said.

Locally, advanced Q4 growth forecasts were mostly in line with street expectations.

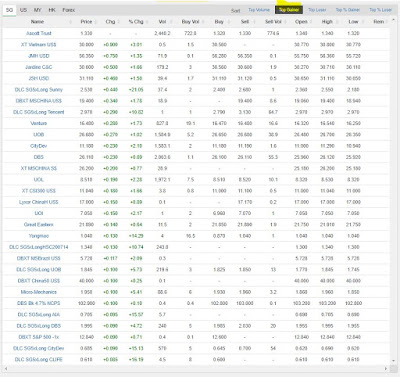

In Singapore, trading volume clocked in at 1.80 billion securities, 1.5 times the daily average in the first 11 months of 2019. Total turnover came in at a muted S$883.15 million, 82 per cent of last year's January-to-November daily average.

Advancers trumped decliners 326 to 141. Just one of the benchmark's 30 counters ended in the red, transport operator ComfortDelgro, which edged down S$0.01 or 0.4 per cent to S$2.37.

Yangzijiang Shipbuilding was the most actively traded of the blue-chip index's counters. Shares in China's largest non-state shipbuilder advanced S$0.04 or 3.6 per cent to S$1.16 with 25.3 million shares changing hands.

Property developers were among the better performers on the day. CapitaLand added S$0.04 or 1.1 per cent to S$3.79, City Developments jumped S$0.23 or 2.1 per cent to S$11.18, and UOL Group gained S$0.19 or 2.3 per cent to S$8.51.

On Thursday, DBS Group Research analysts maintained their "Buy" calls on property developers but increased their price targets. These companies are projected to deliver strong return on equity (ROE) for FY2020-2021 on the back of recent merger and acquisitions, and continued asset recycling activities.

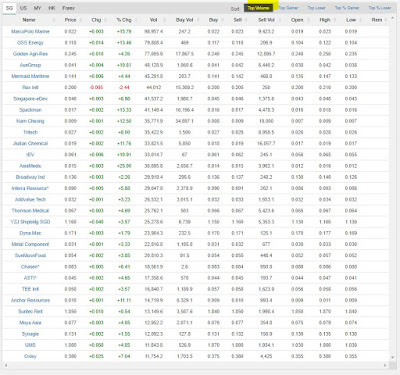

Among pennies, Mermaid Maritime jumped 0.6 Singapore cent or 4.4 per cent to 14.1 cents on 45.3 million shares traded. The provider of engineering services to offshore oil and gas firms said on New Year's eve revealing its associates secured contract extensions worth US$199 million for two of its jack-up drilling rigs.

The Trendlines Group leapt 2.6 Singapore cents or 27.1 per cent to 12.2 cents before the startup incubator before requesting a trading halt in the afternoon, pending the release of an announcement. At the time of the halt, shares were trading at a one-and-a-half year high.

Source: Business Times Breaking News

No comments:

Post a Comment