3,220.090 -3.28 (-0.10%)

| |||

Singapore shares slip as Covid-19 cases surge in Hubei province

13 Feb 2020 18:26

By Navin Sregantan

INVESTOR sentiment in Asia was improving on the back of declining rate of deaths and new cases of infection associated with the novel coronavirus but all of that changed on Thursday.

The reason: Chinese authorities started using a new method of diagnosis, which resulted in sharp increases in both the fatality count and the number of infected in Hubei province, the epicentre of the Covid-19 outbreak.

With the spike suggesting that a bigger-than-expected crisis might be on the cards, AxiCorp chief market strategist Stephen Innes noted: "The Hubei coronavirus update headline has initially hit like a ton of bricks, given this is one of the market's biggest fears."

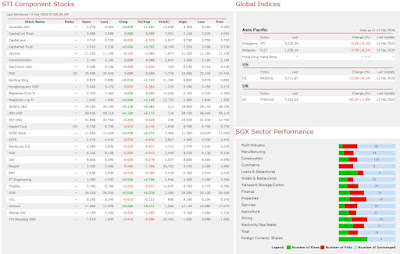

In Singapore, the Straits Times Index (STI) appeared to build on Wednesday's session - its best of the year - before slipping into the red in the afternoon. It eventually settled at 3,220.09, dipping 3.28 points or 0.1 per cent.

Elsewhere in the Asia-Pacific, markets were mixed. China, Japan, Hong Kong, Malaysia and South Korea all ended lower. On the other hand, Australia and Taiwan notched up gains.

For Oanda Asia-Pacific senior market analyst Jeffrey Halley, "the argument that it was a one-off adjustment versus the integrity of China's data collection" was ultimately what left regional stock markets in "somewhat of a limbo".

During Thursday's session in Singapore, trading volume was 1.49 billion securities, 26 per cent over the 2019 daily average. Total turnover came to S$1.19 billion, 12 per cent over last year's intraday mean.

Across the broader market, advancers and decliners were evenly matched at 205 to 204. The blue-chip index had 14 of its 30 components closing in the red.

Genting Singapore, which gained S$0.01 or 1.1 per cent to 88.5 cents, was the benchmark index's most traded stock with 41.2 million shares changing hands. On Wednesday, the casino operator reported a 4 per cent increase in net profit for Q4 to S$156 million though revenue fell 9 per cent to S$607 million. The company foresees a first-half dip in earnings due to the impact the Covid-19 outbreak is having on tourist numbers.

Banking stalwart DBS Group Holdings closed unchanged at S$25.42 after reporting a 14 per cent rise in net profit to S$1.51 billion for Q4. The lender is expecting a revenue impact of around 1 to 2 per cent in FY2020 due to the Covid-19 outbreak.

Fellow STI heavyweight Singtel was among the main laggards. Shares in Singapore's largest telco fell S$0.06 or 1.8 per cent to S$3.28 after posting a 23.8 per cent decline in net profit for Q3 to S$627.2 million.

While most property developers fell, Wing Tai Holdings managed to add S$0.06 or 3 per cent to close at S$2.03. On Wednesday, the company reported a 61 per cent increase in Q2 net profit to S$26 million on higher property sales.

Among penny plays, Catalist-listed OEL (Holdings) was one of the Singapore bourse's most active counters with 110.7 million shares traded. The property management company added 0.3 Singapore cent or 11.9 per cent to 2.9 cents after confirming plans to diversify into early childhood childcare and health education as well as healthcare.

DISCLAIMER:

Hey,

All information updates, tables and charts are for informational purposes only; they are not intended for trading purposes or advice.

We do not and cannot guarantee the accuracy of the information.

Please consult your broker or financial representative to verify pricing before executing any trade.

We are not liable for any actions taken in reliance on information contained herein.

With best regards,

Martin

No comments:

Post a Comment