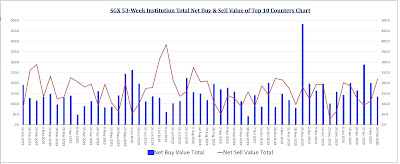

SGX Institutional and Retail Fund Flow Weekly Tracker

Week of 10 February 2020

Institutional investors net sell (-S$113.8m) vs. (+S$162.8m) a week ago

Retail investors net sell (-S$56.3m) vs. (-S$23.7m) a week ago

Top 10 Institution Net Buy (+) Stocks

$SGX(S68.SI)

$Keppel DC Reit(AJBU.SI)

$AEM(AWX.SI)

$ST Engineering(S63.SI)

$Keppel Reit(K71U.SI)

$Ascendas Reit(A17U.SI)

$Mapletree Log Tr(M44U.SI)

$Genting Sing(G13.SI)

$Mapletree Ind Tr(ME8U.SI)

$Venture(V03.SI)

Top 10 Institution Net Sell (-) Stocks

$DBS(D05.SI)

$SingTel(Z74.SI)

$UOB(U11.SI)

$SATS(S58.SI)

$CapitaLand(C31.SI)

$Keppel Corp(BN4.SI)

$Jardine C&C(C07.SI)

$CDL HTrust(J85.SI)

$ComfortDelGro(C52.SI)

$OCBC Bank(O39.SI)

Disclimer

Hey,

All information updates, tables and charts are for informational purposes only; they are not intended for trading purposes or advice.

We do not and cannot guarantee the accuracy of the information.

Please consult your broker or financial representative to verify pricing before executing any trade.

We are not liable for any actions taken in reliance on information contained herein.

With best regards,

Martin

Subscribe to:

Post Comments (Atom)

AEM up 17.81% after 2 months' consolidation.

AEM up 17.81% after 2 months' consolidation. Volume came in 2 sessions ago and I added. I added again when my brokers came calling yes...

-

Explore channel : https://t.me/NewsUpdateLearning

-

SGX Institutional and Retail Fund Flow Weekly Tracker Week of 28 October 2019 Institutional investors net sell (-S$274.5m) vs. (+S$75.7m...

-

STI gap down to open on the bear channel mid-line to rocket up to test its down trend line in the 1st 10mins. Traders booked their profit as...

No comments:

Post a Comment