3,156.570 +40.26 (1.29%)

| |||

Singapore shares gain 1.3% as relief rally supports markets

04 Feb 2020 18:25

By Navin Sregantan

THE lights were flashing green as Asian equity markets had a relief rally following broad sell-offs on Monday when mainland Chinese markets returned from an extended Lunar New Year break.

While the spread of the novel coronavirus remains the key concern in the near term, on Tuesday at least, investors appeared encouraged by the recent slower rate of increases in new cases. Sentiment was also lifted by China's central bank injecting more than US$230 billion into its financial markets from Monday, as well as strong January manufacturing data from the US.

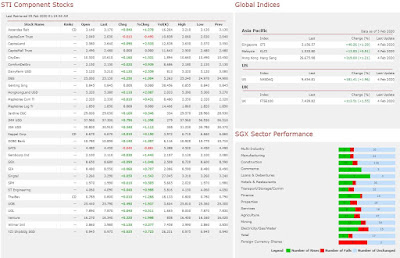

In Singapore, the Straits Times Index ended Tuesday's session at 3,156.57, an advance of 40.26 points or 1.3 per cent.

Elsewhere, Australia, China, Japan, Hong Kong, Malaysia, South Korea and Taiwan posted gains. Of the lot, China's Shanghai Composite Index, which returned from more than a week off on Monday by skidding more than 7 per cent, rose 36.68 points or 1.3 per cent to 2,783.29.

Trading volume in Singapore totalled 1.77 billion securities, 50 per cent over the 2019 daily average. Total turnover was S$1.34 billion, 26 per cent more than last year's intraday mean.

Advancers trumped decliners 296 to 144, with just two of the benchmark's 30 counters ending in the red.

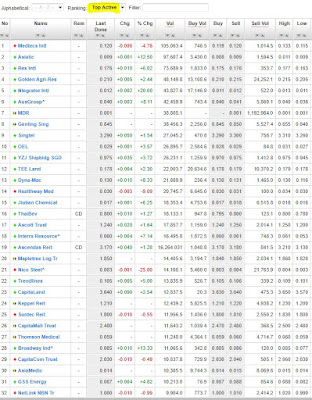

Much like in the past fortnight, shares in Medtecs International continued to be among the Singapore bourse's most active counters.

The medical consumables manufacturer fell 0.6 Singapore cent or 4.8 per cent to S$0.12 with 105.1 million shares traded. Medtecs' shares, which closed out 2019 at 3.9 cents, have finished as high as 19.6 cents in the past week.

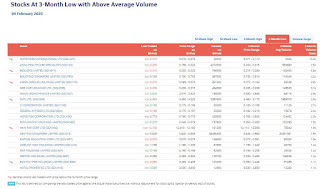

With virus worries still at the top of the agenda for investors and traders alike, listings in tourism- and travel-related industries continue to take a hit.

On Tuesday, UOB Kay Hian analyst K Ajith lowered his call on the Singapore aviation sector to "underweight" as contagion fears have led to numerous flight cancellations and capacity cuts.

SATS, which receives about 86 per cent of its revenue from aviation, fell S$0.04 or 0.9 per cent to S$4.45. The ground handler was downgraded to "hold" due to near-term earnings risks with its exposure to the travel sector.

Mr Ajith expects SATS shares to head towards their "five-year mean price-to-earnings of 20.6 times or about S$4.40 before a price recovery".

For national carrier Singapore Airlines (up S$0.06 or 0.7 per cent to S$8.55), Q4 FY2020 earnings for the group could swing to a loss, reducing FY2020 net profit by 29 per cent to S$483 million, he added.

With the virus unlikely to fade into the rear-view mirror, Stephen Innes, the chief market strategist at AxiCorp, noted "panic/fear" and "the hit to the real economy" as two separate but not mutually inconsistent dynamics that will continue to evolve around the coronavirus.

"The market is still, for the most part, in the fear mode, but as traders consume more economic data, the hit to the real economy should become more apparent. Then, the market will be steered by data, not opinions or the herd mentality," he said.

Source: Business Times Breaking News

Source and recommended reads :

https://sginvestors.io/market/sgx-share-price-performance/straits-times-index-constituents

https://sginvestors.io/market/sgx-breakout-price-3-month-high-volume-above-average

https://sginvestors.io/market/sgx-breakout-price-3-month-low-volume-above-averagehttps://www.investingnote.com/posts/1809889

https://sginvestors.io/market/sgx-breakout-price-3-month-high-volume-above-average

https://sginvestors.io/market/sgx-breakout-price-3-month-low-volume-above-averagehttps://www.investingnote.com/posts/1809889

Singapore business news

https://www.straitstimes.com/business/companies-markets

https://www.theedgesingapore.com/

US Indices & stocks performance

https://www.investing.com/indices/

https://money.cnn.com/data/fear-and-greed/

DISCLAIMER:

Hey,

All information updates, tables and charts are for informational purposes only; they are not intended for trading purposes or advice.

We do not and cannot guarantee the accuracy of the information.

Please consult your broker or financial representative to verify pricing before executing any trade.

We are not liable for any actions taken in reliance on information contained herein.

With best regards,

Martin

No comments:

Post a Comment