3,213.710 +17.08 (0.53%)

| |||

Singapore shares snap 4 sessions of losses, rise 0.5% on Wednesday

19 Feb 2020 18:25

By Navin Sregantan

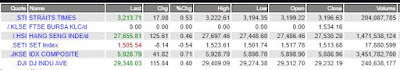

SINGAPORE equities managed to snap a four-session run of losses on Wednesday in what turned out to be a largely positive session for markets in Asia.

The Straits Times Index (STI) was up from the opening bell, gaining as much as 0.7 per cent before settling at 3,213.71. The benchmark registered an advance of 17.08 points or 0.5 per cent. Just two of the blue-chip index's 30 components ended in the red.

Investors in the city-state were buoyed by the slew of support measures, announced at Tuesday's reading of the Singapore Budget for 2020, for companies most affected by the Covid-19 outbreak.

Local equities were riding other tailwinds too. The number of new Covid-19 cases fell globally while sentiment was lifted on hopes of further stimulus measures by China.

With investors having digested the broad details of the government's support package, aviation-related stocks turned the corner. Singapore Airlines added S$0.06 or 0.7 per cent to S$8.57 while ground handler SATS closed up S$0.04 or 0.9 per cent to S$4.52.

Singtel was the STI's most active counter, closing unchanged at S$3.17 with 29 million shares changing hands. Shares in the telco have lost 5.9 per cent since it announced its Q3 earnings last Thursday.

DBS Group Research analyst Sachin Mittal noted on Wednesday that Singtel shares were trading at a holding company discount of 19 per cent - more than its four-year average of 15 per cent - and with a 5.5 per cent yield.

Local tech manufacturers rebounded after outlook was hit by an Apple earnings downgrade for the January-March quarter. AEM Holdings added S$0.05 or 2.3 per cent to S$2.22 while UMS Holdings edged up S$0.01 or 1 per cent to S$1.03.

Trading volume in Singapore was 1.70 billion securities, 44 per cent over the 2019 daily average. Total turnover came to S$1.18 billion, 11 per cent over last year's intraday mean.

Across the broader market, advancers trumped decliners 265 to 147.

Elsewhere in the Asia-Pacific, benchmarks were mostly higher. Australia, Japan, China, Hong Kong, South Korea and Taiwan notched up gains. Bucking the trend was Malaysia, which closed lower.

"With China seemingly announcing targeted stimulus measures by the day and following Singapore's blockbuster Budget (on Tuesday), Asia seems confident that the region's governments will do what it takes to offset the coronavirus slowdown," Oanda Asia-Pacific senior market analyst Jeffrey Halley said of Wednesday's session.

That said, he acknowledged markets were not suffering from blind optimism. "I would describe the tone today as cautiously positive, with Asia not getting too carried away on the post-coronavirus future," he remarked.

With spot gold holding above US$1,600 per ounce, AxiCorp chief market strategist Stephen Innes noted investors were continuing to view the yellow metal "as a quality asset and hedge against the economic impact of Covid-19 amid a laundry list of global growth concerns".

Source: Business Times Breaking News

Source and recommended reads :

https://sginvestors.io/market/sgx-share-price-performance/straits-times-index-constituents

https://sginvestors.io/market/sgx-breakout-price-3-month-high-volume-above-average

https://sginvestors.io/market/sgx-breakout-price-3-month-low-volume-above-average

https://www.investingnote.com/posts/1840592

Singapore business news

https://www.businesstimes.com.sg/stocks

https://www.straitstimes.com/business/companies-markets

https://www.theedgesingapore.com/

US Indices & stocks performance

https://www.investing.com/indices/

https://money.cnn.com/data/fear-and-greed/

DISCLAIMER:

Hello,

All information updates, tables and charts are for informational purposes only; they are not intended for trading purposes or advice.

We do not and cannot guarantee the accuracy of the information.

Please consult your broker or financial representative to verify pricing before executing any trade.

We are not liable for any actions taken in reliance on information contained herein.

With best regards,

Martin

No comments:

Post a Comment