3,117.520 -40.72 (-1.29%)

| |||

Singapore shares slide 1.3% after US warns of sustained Covid-19 spread

26 Feb 2020 18:26

By Navin Sregantan

COVID-19 continues to dominate news flows globally and with the situation still fluid, markets remain volatile, evidenced by the resumption of the sell-off during Wednesday's session in Singapore.

Tuesday's rebound in the local equity market was short-lived as market participants were jolted by word that US health officials expect a sustained spread of the novel coronavirus to take root there. Meanwhile, the number of Covid-19 cases in South Korea continues to climb.

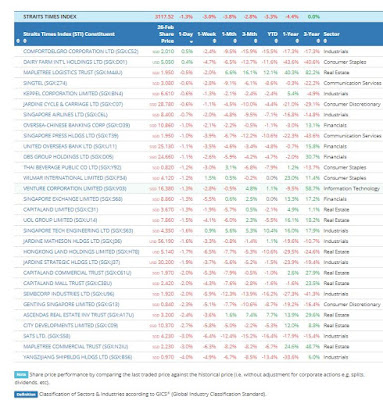

The Straits Times Index (STI), down 0.9 per cent shortly after the opening bell, traded in that range for most of the session before a late dip to close 40.72 points or 1.3 per cent lower at 3,117.52. All but two - ComfortDelGro and Dairy Farm International - of the blue-chip index's 30 components ended in the red.

With volatility reigning supreme, most other Asia-Pacific benchmarks also struggled to put up consecutive sessions of gains. Australia, Japan, China, Hong Kong, Malaysia, South Korea and Taiwan all posted losses for the day.

That being said, the sell-off in Asia was more measured compared to Europe and the US. This is likely due to the region's markets pricing in the economic impact of Covid-19 for about a month now compared to their Western counterparts.

Oanda Asia-Pacific senior market analyst Jeffrey Halley offered another explanation. He said: "In a rerun of (Tuesday), US index futures are tracing out a small profit-taking dead cat bounce, and that appears to be taking the edge off Asian selling interest."

However, US futures reversed course after Europe markets opened. Likewise, the STI dipped further in the last hour of trading.

Interestingly, gold prices moved in tandem with equity market performance. AxiCorp chief market strategist Stephen Innes attributed the yellow metal's weakness "to a combination of profit-taking, and liquidation to raise cash, likely related to margin requirements".

Trading volume in Singapore was 1.52 billion securities while total turnover came to S$1.45 billion. Decliners trumped advancers 321 to 133.

Genting Singapore was the STI's most active counter. Shares in the casino operator fell S$0.02 or 2.3 per cent to S$0.84 with 53.9 million shares traded.

The banking trio also ended lower. DBS Group Holdings fell S$0.27 or 1.1 per cent to S$24.66, OCBC Bank lost S$0.11 or 1 per cent to S$10.86 while United Overseas Bank (UOB) ended at S$25.13, down S$0.27 or 1.1 per cent.

Among listings in the second line, Penguin International fell 3.5 Singapore cents or 4.9 per cent to 67.5 cents after it posted a FY2019 revenue of S$136.3 million and net profit of S$19.4 million, which were in line with street expectations.

Analysts remain positive about the company, which builds and owns niche high-speed aluminium craft.

CGS-CIMB analyst Cezzane See said: "We like Penguin as it is increasingly profitable, cheap (compared to) domestic peers and still in a net cash position, which will accord it dry powder to shore up its build-to-stock inventory."

Meanwhile, UOB Kay Hian analysts see value in Penguin's stock. They said: "We believe that the market is severely undervaluing Penguin's healthy balance sheet and expanding order book."

Source: Business Times Breaking News

Source and recommended reads :

https://sginvestors.io/market/sgx-share-price-performance/straits-times-index-constituents

https://sginvestors.io/market/sgx-breakout-price-3-month-high-volume-above-average

https://sginvestors.io/market/sgx-breakout-price-3-month-low-volume-above-average

https://www.investingnote.com/posts/1852141

Singapore business news

https://www.businesstimes.com.sg/stocks

https://www.straitstimes.com/business/companies-markets

https://www.theedgesingapore.com/

US Indices & stocks performance

https://www.investing.com/indices/

https://money.cnn.com/data/fear-and-greed/

DISCLAIMER:

Hello,

All information updates, tables and charts are for informational purposes only; they are not intended for trading purposes or advice.

We do not and cannot guarantee the accuracy of the information.

Please consult your broker or financial representative to verify pricing before executing any trade.

We are not liable for any actions taken in reliance on information contained herein.

With best regards,

Martin

No comments:

Post a Comment